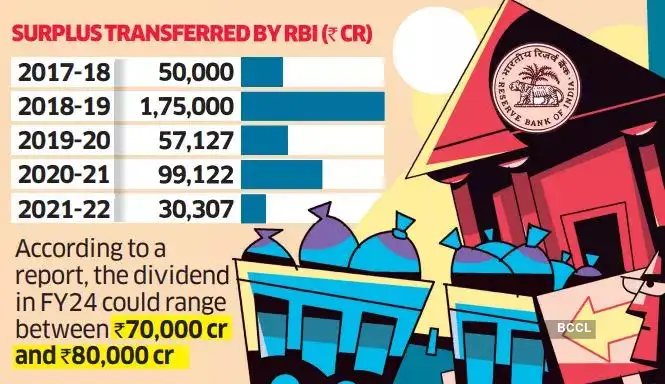

The Budget has estimated receipts of ₹48,000 crore in FY24 by way of total dividends from public sector banks and the RBI.

“Given the large levels of dollar sales and low provisioning requirements, the RBI dividend is expected to exceed Budget estimates,” Gaura Sengupta, India economist, IDFC First Bank, said in her recent report. “We estimate that the dividend from the RBI could range between ₹70,000 crore and ₹80,000 crore. The better-than-expected RBI dividend will balance some of the risks facing tax revenue collections, from slower-than-budgeted nominal GDP growth.” For FY22, the central bank had transferred a surplus of ₹30,307 crore to the Centre.

Combined gains out of foreign currency sales and interest on loans to the local banking system may more than offset the mark-to-market losses on bond portfolios – both local and overseas. The valuation of foreign exchange transactions at historical costs could help the central bank that sold a gross $206 billion during April-Feb of FY23, up from $96 billion in the previous fiscal.

The central bank’s revised accounting framework, as recommended by a committee headed by former governor Bimal Jalan and adopted in 2019, stipulates that the accounting practice of forex operations be linked to historical costs against the earlier practice of week-to-week costs.

Average historical cost of dollar purchases is estimated around Rs 63 a unit. But the market price at which RBI sold dollars averaged Rs 80 during the year. The RBI had earned Rs 68,990 crore in FY22 out of its foreign exchange transactions involving gross dollar sales of $96 billion. Hence, the income from selling more than $200 billion could be substantial after adjusting for dollar purchases during the year and other swaps and forward transactions.

“So the total amount of foreign exchange sold against total bought is large, and the RBI is likely to find space to pay dividends from a smaller need for capital adequacy and profits made on forex transactions,” said Rahul Bajoria, Head of EM Asia (ex China), economics research, Barclays Capital.

A higher outgo on dividends could also be due to higher interest rates during the year and the RBI was in a reverse repo mode, according to Madan Sabnavis, chief economist, Bank of Baroda.

Interest income on bond holdings and liquidity adjustment facility (LAF), too, is not expected to be significantly higher. But lending to banks under various windows may earn higher interest income as the benchmark repo rates against which it lends to banks have climbed 2.5 percentage points during the year.

Outstanding loans and advances to commercial banks alone are at Rs 1.65 lakh crore – Rs 70,000 crore higher in FY23. In addition, there is an additional Rs 1.11 lakh crore exposure to other entities, or Rs 30,000 higher than in the previous year. This could lead to a sharp surge in interest income from loans and advances for the central bank. In FY22, the RBI had earned Rs 1,500 crore on domestic loans and advances on a portfolio of Rs 1.3 lakh crore.