This is despite retail demand softening this month with long waiting periods of up to a year for some models and an oversupply of others leading to discounts, reflecting a highly uneven market, experts said.

For instance, sport utility vehicles (SUVs) are popular, smaller cars not so much. Meanwhile, all prices have surged over the past three years.

ET Online

ET OnlineCos Trying to Balance Supply and Demand

The high price is threatening to put the brakes on car purchases as inflation erodes disposable income. The semiconductor shortage last year had hit models across segments. This time, discounts and waiting periods are model-specific, said Shashank Srivastava, senior executive director, Maruti Suzuki India Ltd. High interest rates and increasing prices continue to have a negative effect on entry-level model sales, he said.

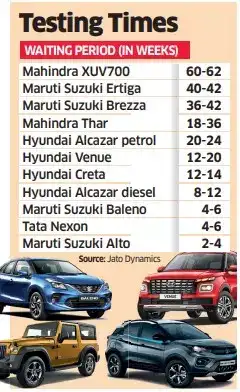

Models of Maruti Suzuki, Hyundai, Mahindra and Tata Motors have waiting periods, which is proving to be a dampener for customers, according to Jato Dynamics estimates. These range from two weeks for a Maruti Suzuki Alto to 62 weeks for a Mahindra XUV700.

Manufacturers are trying to balance supply and demand given that customers can’t buy the models they want and there are discounts on others. This has led to the estimate of PV sales this month being cut to 310,000 units from 350,000 earlier.

SUVs account for more than half the PV segment. There is a softening of demand in the segment of cars priced below Rs 10 lakh, with shorter waiting periods of one to three months. This price-sensitive segment is seeing a slowdown, said Veejay Nakra, president, Mahindra Automotive.

This price-sensitive segment is seeing a slowdown, said Veejay Nakra, president, Mahindra Automotive. Consumers are willing to wait longer for a model when the value proposition is strong and the product is well differentiated, he said.

Some experts pointed out that 3.9 million would be a record but is only 14% higher than FY19 sales. This is incremental growth when seen from a historical perspective, Srivastava said.

In the current market, many buyers are finding it hard to get their hands on popular new vehicles despite visiting several dealerships. Meanwhile, car prices have significantly risen in the last three years and this has forced many buyers to review their choices, said Ravi Bhatia, president of Jato Dynamics. To be sure, the long waiting list is generally viewed with caution as it may reflect multiple bookings and is liable to large numbers of cancellations, said Srivastava.

Economic fundamentals indicate some stress as higher inflation, rising interest rates and slower growth will reduce disposable income and hence lower the inclination to spend on discretionary products such as cars. This is already evident in the smaller car segment.