A giant Chinese cargo ship lumbers down the West Coast of Africa before making its way around the Cape of Good Hope. The ‘BYD Explorer 1’ is returning from a potentially game-changing trade mission: to flood Europe with cheaper electric cars, and knock Tesla off its perch.

The 200-metre long vessel is two weeks into the return leg of its maiden voyage, having dropped off more than 5,000 vehicles at ports in the Netherlands, Germany and Belgium.

Its final destination is Shenzhen in South-East China, whence it set sail more than two months ago.

This bustling city near Hong Kong is home to the ship’s owner, BYD. This is a company so big it has built its own walled town, complete with an airport-style monorail for workers.

The brand – which stands for Build Your Dreams – is backed by legendary US investor Warren Buffet and is the biggest car manufacturer most Westerners have never heard of.

Show piece: BYD launched its all-electric Yangwang U9 three weeks ago to rival Ferrari

But that is about to change. BYD recently pipped Elon Musk’s Tesla to become the biggest-selling manufacturer of electric cars in the world in the final three months of last year.

Some are dubbing BYD the ‘Tesla Killer’, after it came out on top in a brutal price war in China, a country which builds and buys more electric cars than the rest of the world combined. BYD looks unstoppable.

However, old-fashioned protectionism might slam on the brakes. Despite ambitious environmental targets to ban sales of new petrol and diesel cars in just over a decade, the UK’s Trade Secretary Mark Harper last week said Britain could use ‘robust’ trade sanctions to prevent China from flooding the market with cheap electric vehicles.

And the post-Brexit trade watchdog, the Trade Remedies Authority, has also signalled it is ready to launch an investigation into Chinese EVs.

Lawmakers in Europe and the US have baulked at the prospect of their citizens buying cheaper electric cars, subsidised by the People’s Republic of China.

BYD has received a total of £2 billion in subsidies from the Communist government in Beijing between 2008 and 2022, it said in its annual reports.

European Commission president Ursula von der Leyen complained in September this was making the price of its cars ‘artificially low’.

T he company, however, is forging on and the Explorer 1 signals the next logical phase in its quest for global domination.

Of the three million cars BYD sold last year, just 243,000 were exported.

The slowdown in global sales of electric cars, including in China, has given BYD more urgency to expand overseas.

This is why it has commissioned seven more cargo ships, all capable of carrying up to 7,000 electric cars, to take to the high seas within the next two years.

It has set up assembly lines in Brazil, Hungary, Thailand and Uzbekistan. More manufacturing plants are in the pipeline in Indonesia and Mexico, which is seen by BYD as a back door into the US market.BYD has a knack for making well-designed vehicles more cheaply than its rivals.

The firm recently announced the launch of its cheapest car yet in China – a super-mini called the Seagull Honor Edition, costing the equivalent of less than £8,000.

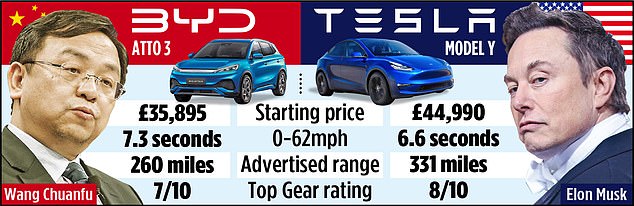

It launched its first model in the UK last year, the Atto 3 SUV, which starts at about £36,000, roughly £9,000 less than Tesla’s equivalent, the Model Y – Europe’s best-selling new car last year.

BYD’s all-electric Yangwang U9 Supercar, with its distinctive scissor doors, was launched three weeks to rival Ferrari and Lamborghini. However, about half of BYD’s sales are popular plug-in hybrids, which has helped give it an edge over Tesla as global appetite for electric cars has waned.

The company was founded in 1995 by Wang Chuanfu – a chemist who came from a poor farming family – when he was just 29.

Now known as ‘the chairman’, he made his initial fortune manufacturing mobile phone batteries and other components for Siemens, Nokia and Motorola, before branching out into building cars after buying an assembly plant in Xi’an in central China in 2003.

BYD’s potential was spotted by Warren Buffett’s right-hand man, the late Charlie Munger, in 2008, several years before the company launched its first electric car.

Buffett’s Berkshire Hathaway investment vehicle bought a 10 per cent stake for £181 million.

The holding, which has been whittled down to about 8 per cent, is now worth £5.1 billion.

Wang scored another major coup in 2016 by poaching Wolfgang Egger, a prominent German car designer who had worked for Alfa Romeo, Audi and Lamborghini.

BYD’s cars, which until then had a reputation for being unattractive, were given a sleek makeover.

A few years later, Wang made a technological breakthrough with the launch of cheaper and more efficient ‘Blade’ batteries in 2020, which are used by Tesla and Toyota in some of their models.

This helped turbo-charge growth at BYD, which has a stranglehold on the supply chain for EV batteries, owning everything from stakes in lithium mines to the battery packs themselves.

It reached a key milestone in the final three months of last year, when it sold 526,409 fully electric vehicles, compared with 484,507 sold by Tesla (although the American company still sold more over the course of the year). BYD’s meteoric rise has spooked more established car manufacturers around the world. They have clamoured for tougher trade barriers to stem the great Chinese electric car invasion.

Musk, who ridiculed the appearance of BYD cars in 2011 when he dismissed them as no threat, has changed his tune. In an earnings call with investors in January, he warned that Chinese car exporters would ‘pretty much demolish most other companies in the world’ unless new trade tariffs are quickly established.

Pushback from Western governments is the biggest threat to BYD’s advance.

Higher tariffs are on the cards, with the EU launching a probe into whether not just BYD, but also other Chinese car manufacturers such as Geely – which owns Volvo – and SAIC, which owns MG, benefit from ‘hidden’ government subsidies, including cheap loans and supplies of steel and electricity.

Tariffs of 27.5 per cent on Chinese electric car imports imposed by the Trump regime have helped freeze BYD out of the US market.

Earlier this month US president Joe Biden took further steps towards blocking Chinese electric vehicle imports, by warning that internet-connected cars and trucks pose risks to national security.

But as things stand, BYD is still in pole position to overtake its rivals.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.