Hold onto your mugs, coffee enthusiasts, because it looks like your beloved brew is about to take you on a rollercoaster ride through the wild world of caffeine economics.

This increase in cost is attributed to a shortage of coffee beans on a global scale, particularly stemming from Brazil and Vietnam, coupled with unexpected rains affecting bean quality in India. This unfavorable situation has led to a surge in domestic market prices.

Coffee traders, who usually acquire premium beans from Chikkamagaluru in Karnataka, have begun transferring this price escalation to their customers.

Latha Aravind, a resident of Mumbai’s Matunga, said that the cost of usual mixed coffee grounds – a blend of Robusta and Peaberry beans – has risen from around Rs 580/kg to about Rs 640 to Rs 650/kg.

“Prices have shot up and may keep rising,” she told Times of India.

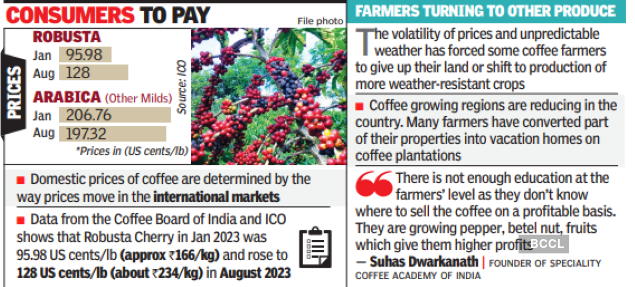

Rajesh Gandhi, owner of Gandhi’s Coffee, a well-known coffee trading enterprise in Pune, said that he had to pass on a Rs 50/kg price hike to the end consumers, as Robusta beans have undergone an approximate 50% price surge, while Arabica beans area dearer by about 15%.

Ajit Raichur, a coffee trader from Kumardhara Traders, said that coffee prices are typically adjusted annually in January. However, this year witnessed an additional price hike of Rs 50/kg across all available bean varieties in July.

GM Dharmendra, a wholesale green coffee (raw beans) trader based in Bengaluru, said he lost 30% to 40% business over the last few months. “Many small coffee retailers in the area have shut shop or they are buying poor quality beans at cheaper rates. Many customers have shifted to instant coffee,” he added.

The coffee-growing region of Chikkamagaluru has borne the brunt of climate change impacts. Rohan Kuriyan, manager of Balanoor Plantations and Industries, reported a 20% decrease in yield due to untimely rainfall during blossom days, compared to the previous year. “The average cost of picking has also gone up. We ended up doing four rounds of selective harvesting instead of the usual two because of the uneven ripening of the cherries,” he added.

“With some positive news about better crop in Brazil, Arabica prices have started softening in the international markets. However, prices are expected to be a bit higher in the domestic market which is growing at double digits because of demand and less production,” Challa Srishant, MD of CCL Products (India) and member of the Coffee Board of India, said.

CCL Products, known for its ‘Continental’ coffee brand, has raised prices from Rs 280 to Rs 360 for a 200g jar within a year, with a further 10% increase planned for the next quarter. Observers in the industry have noted that the diminishing price gap between Arabica and Robusta has inclined consumers towards the smoother and sweeter profile of Arabica beans.

“For planters, operational costs have gone up – right from labour costs to fertilizer and pesticide costs. Coffee prices (Arabica) are a little lower now than they were last year but traders usually buy in bulk and therefore it appears like they are protecting their bottom line in case prices rise again,” Mahesh Shashidhar, chairman of Karnataka Planters’ Association said.

The harvesting season for Robusta beans is six-to-seven months away, and there is uncertainty about the next crop. Karnataka remains a dominant player, contributing 70% of India’s coffee production, while Kerala and Tamil Nadu also cultivate coffee. Industry stakeholders have collectively absorbed various price increases at different junctures. Although prices haven’t been adjusted yet, Amit Bhatta, founder of the specialty coffee brand Aeka Coffee, conceded that an additional 15% to 20% increase could prompt a shift of this burden onto the end consumers.

(with inputs from ToI)