Bitcoin Spot Exchange-Traded Funds (ETFs) have once again garnered the attention of crypto enthusiasts and investors as the products have witnessed a whopping $10 billion in total trading volume in the first three days of trading.

Bitcoin Spot ETF Sees Significant Uptick In Day 3 Trading

The development was revealed by Bloomberg Intelligence analyst James Seyffart on the social media platform X (formerly Twitter). The information shared by the analyst demonstrates a firm desire for exposure to digital assets via regulated financial markets.

Seyffart’s X post delves in on the data from the “Bitcoin ETF Cointucky Derby.” According to the analyst, “ETFs traded almost $10 billion in total over the past 3 days.”

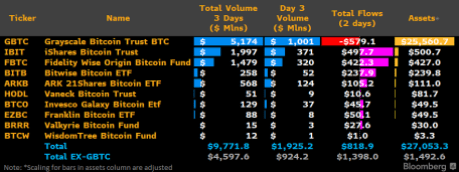

The analyst also provided a virtual record of the data to further elaborate on the substantial trading volume. With a total volume of over $5 billion, Grayscale Bitcoin Trust (GBTC) stands out as the top performer among the notable financial firms.

Meanwhile, iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) come next in line. The data shows that the financial firms witnessed an overall trading volume of $1.997 billion and $1.479 billion, respectively.

ARK’s 21Shares ETF (ARKB) and Bitwise Bitcoin ETF (BTTB) followed behind with a substantial total trading volume of $568 million and $258 million, respectively. This spike in trading volume indicates that both institutional and individual investors are growing more at ease utilizing traditional investment engines to trade BTC.

Although Grayscale’s Bitcoin fund continues to gain the highest overall trading volume, the fund has seen significant withdrawals from investors seeking to lower their exposure.

There have been withdrawals totaling more than $579 million since Grayscale started trading on January 11. Currently, Grayscale is still considered the “Liquidity King” of the Bitcoin spot ETFs.

However, Bloomberg analyst Eric Balchunas anticipates that Blackrock might oversee Grayscale to claim the title. “IBIT keeping lead to be one most likely to overtake GBTC as Liquidity King,” he stated.

3-Day Trading Surpassed 500 ETFs In 2023

Following the report, Eric Balchunas has provided a context for the massive surge of these products. The analyst did so by comparing the trading volume of BTC ETFs to all the ETFs that were launched in 2023.

“Let me put into context how insane $10b in volume is in the first 3 days. There were 500 ETFs launched in 2023,” Balchunas stated. According to him, the 500 ETFs completed a $450 million combined volume today, and the best one did $45 million.

In addition, Balchunas highlighted that Blackrock‘s BTC ETF demonstrates a better performance than the 500 ETFs. “IBIT alone is seeing more activity than the entire ’23 Freshman Class,” he stated. It is noteworthy that half of the ETFs launched in 2023 recorded an overall trading volume of “less than $1 million” today.

Balchunas also stressed the difficulty in acquiring volume, noting that it is harder than flows and assets. This is because the volume has to come genuinely in the marketplace, which gives an “ETF lasting power.”

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.