While the tax benefits on these investments have shrunk in the past few years, things have been very different for the National Pension System (NPS). Tax benefits for the NPS have progressively increased in the past 10 years, each change making the pension scheme more advantageous for the investor. This year’s Budget has enhanced the tax deduction for those opting for the new tax regime. Under Section 80CCD(2), up to 10% of the basic pay put in the NPS is tax-free. This has been increased to 14% of the basic pay under the new tax regime.

This makes the NPS a compelling investment. A person with a basic salary of Rs.1 lakh a month can potentially save Rs.52,000 in tax by opting for the NPS benefit. High income earners with large investible surpluses will find it especially beneficial. Some corporates are going the extra mile to encourage their employees to sign up for the pension scheme. “A leading MNC offered to contribute Rs.1,000 for six months for every employee who chose to open an NPS account. It’s like a Swavalamban scheme for corporate employees,” says Sriram Iyer, CEO of HDFC Pension.

Magic of compounding

If given enough time to grow, investment in the NPS can transform the life of investors. “We see a lot of people with very large Provident Fund corpuses of Rs.2-3 crore. If 8.5% return could build such a huge corpus over 25-30 years, imagine what the 10-10.5% return from the NPS could do,” says Iyer.Apart from the tax benefits enjoyed by the NPS, the Pension Fund Regulatory and Development Authority (PFRDA) has done its bit by making the scheme more flexible. Last year, it allowed investors to spread their investments across different fund managers. Investors are also allowed to stagger the withdrawal of 60% portion of the corpus till the age of 75.

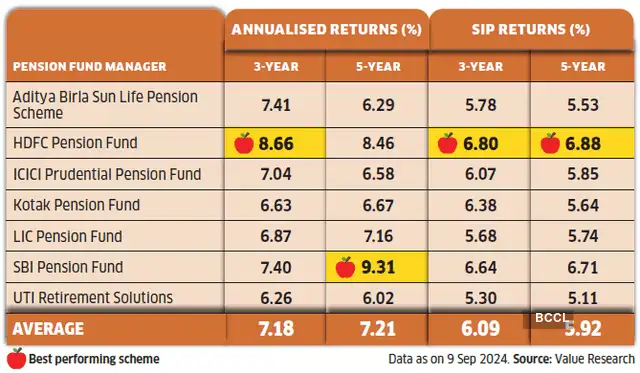

Our cover story this week identifies the best performing NPS funds to help investors decide which pension fund manager they should opt for. Don’t look at the annualised returns in isolation. They are point-to-point returns and may not give the correct picture. The SIP returns, which are calculated using the internal rate of return formula, will be a better indicator, especially if you intend to invest through monthly SIPs.

EQUITY FUNDS

Equity bull run continues to enrich aggressive investors however, growth in corporate earnings is moderating so lower your expectations

Equity funds of the NPS have rewarded investors handsomely. In the past year, the average equity fund delivered 32% return, compared to the 27% rise in the Nifty. This is because the PFRDA relaxed investment norms in 2021, allowing NPS equity funds to go beyond the index and invest in stocks with a market cap of at least Rs.5,000 crore.

So, while most funds are decidedly large-cap oriented, some also have sizeable investments in mid-cap stocks. For instance, Coromandel International is among the top five holdings of newcomer DSP Pension Fund. “We follow a strategy of a concentrated portfolio. We generally prefer companies with zero debt because such stocks tend to do well in the long term,” explains Rahul Bhagat, CEO of DSP Pension Fund. Mid-cap stocks are more volatile, but also more rewarding. DSP Pension Fund’s equity scheme has shot up 21% in the past six months, while the average equity fund rose 15.33% and the Nifty only 13.7%.

There are some surprises in the equity fund ranking this year, with UTI Retirement Solutions emerging as the best performing pension fund. The SIP returns of the pension fund are also the highest, an indication of the fund’s consistency. Investors should watch the performance of another newcomer. The equity fund of Tata Pension Management has given 35.78% return in the past year.

Equity funds have given high returns, but don’t expect this to continue at the same pace. “Corporate earnings are growing faster than India’s overall growth. However, growth is moderating, so investors need to lower their expectations,” says Amit Ganatra, Head of Equities at Invesco Mutual Fund.

“NPS funds do not face the possibility of redemption pressure. So pension funds can invest in long-term bets with conviction.”

RAHUL BHAGAT,CEO, DSP PENSION FUND

GILT FUNDS

Bond funds poised for bounceback if interest rates are cut: Rate cuts will prove beneficial for the funds holding long-term bonds

After several years of insipid growth, gilt funds have bounced back. In the past year, the average return has been in double digits. The long-term performance is also quite decent. Aditya Birla Sun Life Pension Fund has been the best performing scheme in the past 3-5 years, but as mentioned earlier, investors should not see the annualised returns in isolation. The SIP returns are a better indicator of how much investors actually made. The long-term SIP returns of the NPS gilt funds are not very impressive.

The situation could become better when the interest rate cycle turns. Consumer inflation is comfortably below the RBI’s medium-term target of 4%, raising hopes for an interest rate cut. The 10-year government bond yield has averaged 7% in the past nine months. The average yield to maturity of NPS gilt funds roughly mirrors the prevailing yield. NPS schemes usually have very long-term bonds in their portfolios, which are more sensitive to interest rate changes. If the RBI decides to cut rates, NPS gilt funds are likely to do very well.

However, some analysts say inflation has softened due to the base effect and will climb to 4.5-5% in the coming months. This could delay the anticipated cut in rates. “The RBI will not begin its rate easing cycle before the third quarter of 2024-25, despite an increased likelihood of a Fed rate cut in September,” says Arsh Mogre, Economist, Institutional Equities at Prabhudas Lilladher.

Gilt funds suit investors looking for low, but stable, returns. Although they are not for long-term investors, individuals who will retire in 2-3 years can slowly shift from equity schemes to gilt funds to reduce the portfolio risk.

“RBI won’t begin easing rates before the third quarter of 2024-25, despite the likelihood of a Fed rate cut in September.”

ARSH MOGRE ECONOMIST, INSTITUTIONAL EQUITIES, PRABHUDAS LILLADHER

CORPORATE BOND FUNDS

Short-term maturity profile of holdings proved to be a drag: Relaxation of investment norms has enhanced the risk profile of these funds

Unlike gilt funds that hold very long-term bonds, corporate bond funds have a shorter maturity profile. The average maturity of bonds is about 5-6 years, compared to 12-15 years in gilt funds. This reduces the risk by making the portfolio less sensitive to rate changes. Corporate bond funds have, therefore, not gained as much as gilt funds in the past year. Their long-term performance also lags behind gilt funds.

HDFC Pension continues to hold the pole position across time horizons. Its SIP returns are also the highest, although there is not much variation in the returns of the eight pension funds. Experts say investors should not go by returns when it comes to bond funds, but examine the risk profile of the portfolio. The PFRDA has allowed these funds to invest in bonds with an A rating, as long as this exposure is not more than 10% of the portfolio. This exposure to high-yield paper might boost returns, but also enhances the risk of the portfolio. One bad call can play havoc with the fund’s NAV and wipe out the gains of several months. “Corporate bond funds of the NPS have a higher risk profile than gilt funds, but the PFRDA allows pension funds to invest only in bonds with a minimum rating of AA, though we don’t go below AA+,” says Bhagat of DSP Pension Fund.

Even if we assume that the bonds in a fund’s portfolio are safe, corporate bond funds are best avoided in the current scenario. The shorter maturity profile of corporate bond funds makes them useful when rates are rising because they are less sensitive to interest rate changes. They are not the best option when the market is expecting a rate cut. Long-term investors should also avoid these funds.

“If 8.5% returns can build a huge Provident Fund corpus in 25-30 years, imagine what 10-10.5% returns from the NPS could do?”

SRIRAM IYER,CEO, HDFC PENSION

ALTERNATIVE INVESTMENTS

Marked improvement in returns over previous years: The wide variation in returns means investors need to choose carefully

This fourth option was introduced a few years ago. These funds invest in real estate investment trusts (REITs) and Infrastructure Investment Trusts (InvITs). REITs invest in completed and under-construction real estate projects and must have at least 80% of the assets in completed and income-generating properties. InvITs invest in infrastructure projects, such as roads, power plants, highways and warehouses. At least 80% of the corpus has to be invested in completed and revenue-generating infrastructure projects. Alternative investment funds suffered a setback when the new tax rules were proposed for REITs in 2023. However, a subsequent amendment put REITs back on track. In the past year, the average alternative investment fund has generated doubledigit returns, though the long-term returns are not as impressive.

HDFC Pension leads the pack in this category. There is a wide variation in the returns of the eight funds, so investors should choose a fund carefully. Investors who are bullish on infrastructure and real estate should go for these funds.

Alternative investment funds were introduced to help diversify the portfolio, but this diversification also enhances the risk. Some experts believe this risk is not worth the returns these funds have generated in the past. “Please note that there is a 5% cap on the exposure to these funds. This is cognisant of the risks of investing in this sector,” says Deepti Goel, Associate Partner, Alpha Capital. Perhaps this is why the three Lifecycle funds of the NPS do not invest in this asset class.

“The 5% cap on exposure to the alternative investment funds is cognisant of the risks of investing in this sector.”

DEEPTI GOEL ASSOCIATE PARTNER, ALPHA CAPITAL