This, even as it slashed the valuation of Byju’s by almost half, underscoring that the beleaguered edtech platform was a big drag on funds managed by Baron.

Baron Capital said that the reduction in the fair market value of its holding in Byju’s was necessitated by recent events such as the change in the edtech company’s auditor, the resignations of three board members, and the withdrawal of Covid19-related tailwinds for the sector.

In its April-June quarterly report, Baron Capital cut the valuation of Byju’s to $11.7 billion as of June 30, down 44.6% from $21.2 billion as of March 31.

Meanwhile, it has marked up the value of its stake in Swiggy by 33.9% from March-end to $8.54 billion, while that of Pine Labs has been increased to $4.92 billion as of June 30, up 10% from a quarter ago.

In its report, the investment group noted that Indian equities returned to leadership, “as valuations reset after two consecutive quarters of underperformance and the economic and earning expansion in the country continued on a healthy course”.

Discover the stories of your interest

“This reversal was the principal driver of our second quarter outperformance and we maintain conviction that India likely offers the most attractive long-term investment opportunity in the EM (emerging markets)/Asia universe,” it added.As of March 31, funds managed by Baron Capital had reduced the valuations of their holdings in Swiggy and Pine Labs by 10% and 5%, respectively, compared to their value on December 31

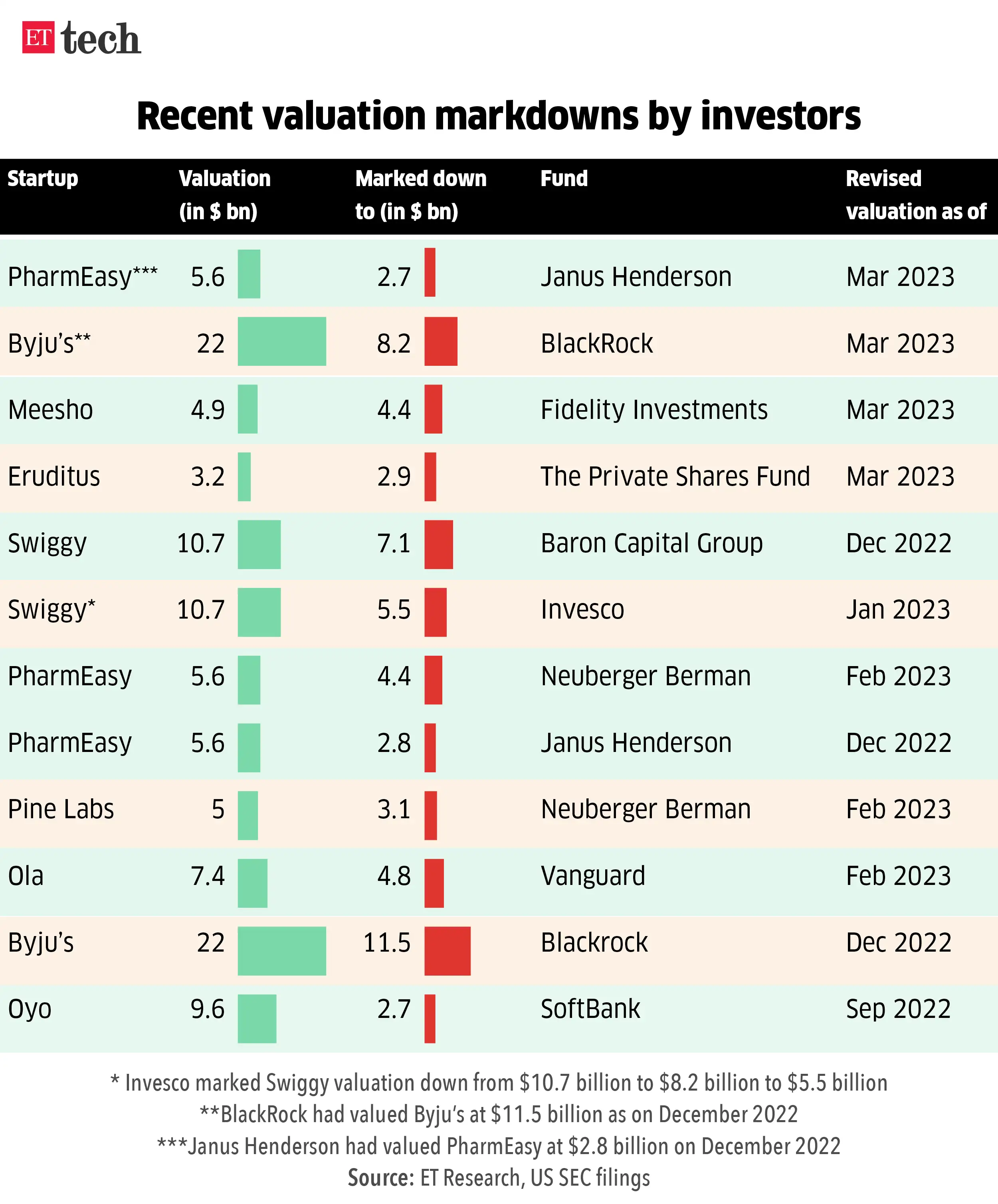

Several other crossover funds, including Fidelity, Blackrock and Invesco, had revised the valuations of Swiggy, Pine Labs and Byju’s. In addition, several other consumer internet startups such as PharmEasy, Gupshup, Meesho and Eruditus have witnessed valuation markdowns over the last few quarters.

Valuations of large internet giants in India have come into focus over the past few quarters, as macroeconomic headwinds have led to a funding slump. Further, as inflation fears grip global economies, public funds have been correcting the value of their stakes based on market conditions.

Large investors such as Softbank Vision Fund, credited for writing big domestic cheques, have said that the unwillingness of Indian startups to opt for down rounds is also one of the key reasons for a slump in late-stage deal activity.

ETtech

ETtechByju’s woes

In its quarterly report, Baron Capital said that the parent entity of Byju’s — Think & Learn Pvt Ltd — saw a weak performance that was driven by a marked slowdown in business momentum as Covid-19-related tailwinds dissipated.

“In addition, Byju’s announced that Deloitte had resigned as its auditor and will be replaced by BDO (another top five global audit firm). Three investor-appointed Board Directors also resigned during the (April-June) quarter. These developments were deemed as material adverse events that required the fair market value of our holdings to be adjusted down accordingly,” the investor pointed out.

This comes as Byju’s continues to douse fires with challenges emerging with its lenders, investors, employees and even customers.

In June, Prosus confirmed the resignation of its representative Russell Dreisenstock from the board of Byju’s, along with other board members GV Ravishankar of Peak XV Partners (formerly Sequoia Capital India) and Vivian Wu of Chan Zuckerberg.

The following month, Prosus said the decision to exit was taken after it became clear that the executive leadership at Byju’s regularly “disregarded advice and recommendations relating to strategic, operational, legal, and corporate governance matters”.

Baron Capital isn’t the only Byju’s investor that has marked down its investment in recent months.

In June, Dutch multinational Prosus marked down the fair value (FMV) for its almost 10% stake in Byju’s to $493 million (as of March 2023).

The markdown represented an enterprise valuation of about $5.1 billion, a sharp decline against the $22 billion valuation ascribed by Prosus when the edtech company last raised equity funding in October 2022.

For the quarter ended March 31, BlackRock had marked down the value of its stake in Byju’s to $8.2 billion.

Despite hardships, Baron Capital also noted that as India’s largest education technology player, Byju’s was “well positioned, in our view, to benefit from structural growth in online education services in the country”.

“While we are disappointed with recent developments, we continue to believe that Byju’s remains a dominant franchise and can sustain low to mid-20s earnings growth in coming years,” it added.