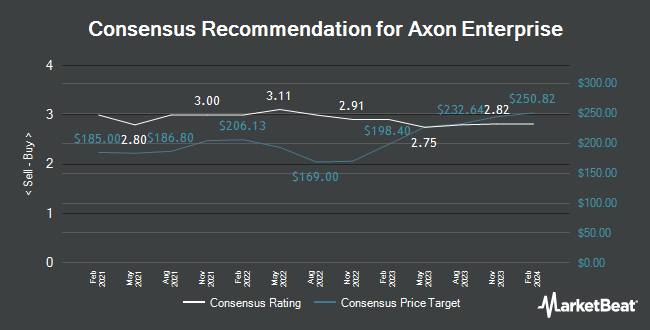

Several other equities analysts also recently weighed in on the stock. TheStreet downgraded shares of Axon Enterprise from a “b” rating to a “c+” rating in a report on Tuesday. JPMorgan Chase & Co. lifted their price objective on shares of Axon Enterprise from $285.00 to $330.00 and gave the company an “overweight” rating in a research report on Wednesday. JMP Securities lifted their price objective on shares of Axon Enterprise from $250.00 to $285.00 and gave the company a “market outperform” rating in a research report on Tuesday, February 6th. Needham & Company LLC lifted their price objective on shares of Axon Enterprise from $240.00 to $315.00 and gave the company a “buy” rating in a research report on Wednesday. Finally, Morgan Stanley lifted their price objective on shares of Axon Enterprise from $250.00 to $285.00 and gave the company an “equal weight” rating in a research report on Wednesday. One analyst has rated the stock with a hold rating and ten have given a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of “Moderate Buy” and a consensus price target of $289.18.

View Our Latest Analysis on Axon Enterprise

Axon Enterprise Price Performance

Shares of NASDAQ:AXON opened at $307.37 on Friday. The company has a debt-to-equity ratio of 0.44, a current ratio of 3.15 and a quick ratio of 2.78. Axon Enterprise has a 1-year low of $175.37 and a 1-year high of $318.90. The company has a market capitalization of $23.03 billion, a P/E ratio of 133.64 and a beta of 0.90. The firm’s 50 day simple moving average is $260.37 and its two-hundred day simple moving average is $231.22.

Insider Buying and Selling

In other Axon Enterprise news, insider Jeffrey C. Kunins sold 2,729 shares of Axon Enterprise stock in a transaction on Monday, December 4th. The shares were sold at an average price of $230.79, for a total transaction of $629,825.91. Following the completion of the transaction, the insider now directly owns 233,291 shares of the company’s stock, valued at $53,841,229.89. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. In other Axon Enterprise news, insider Jeffrey C. Kunins sold 1,796 shares of Axon Enterprise stock in a transaction on Monday, December 18th. The shares were sold at an average price of $253.46, for a total transaction of $455,214.16. Following the completion of the transaction, the insider now directly owns 228,805 shares of the company’s stock, valued at $57,992,915.30. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Jeffrey C. Kunins sold 2,729 shares of Axon Enterprise stock in a transaction on Monday, December 4th. The stock was sold at an average price of $230.79, for a total transaction of $629,825.91. Following the transaction, the insider now directly owns 233,291 shares of the company’s stock, valued at $53,841,229.89. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 43,281 shares of company stock worth $10,811,720. Insiders own 6.10% of the company’s stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the company. BKM Wealth Management LLC purchased a new stake in shares of Axon Enterprise during the fourth quarter valued at $32,000. Hollencrest Capital Management purchased a new stake in shares of Axon Enterprise during the first quarter valued at $29,000. ICA Group Wealth Management LLC purchased a new stake in shares of Axon Enterprise during the fourth quarter valued at $25,000. Jones Financial Companies Lllp purchased a new stake in Axon Enterprise in the second quarter worth about $30,000. Finally, Key Financial Inc lifted its stake in Axon Enterprise by 367.6% in the fourth quarter. Key Financial Inc now owns 159 shares of the biotechnology company’s stock worth $41,000 after acquiring an additional 125 shares during the period. 76.52% of the stock is owned by hedge funds and other institutional investors.

About Axon Enterprise

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Further Reading

Receive News & Ratings for Axon Enterprise Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Axon Enterprise and related companies with MarketBeat.com’s FREE daily email newsletter.