Stay informed with free updates

Simply sign up to the Property sector myFT Digest — delivered directly to your inbox.

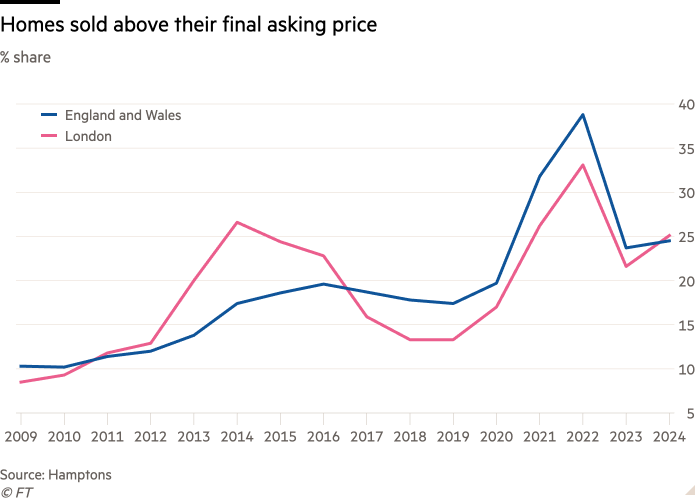

A home in London is more likely to sell above its asking price than elsewhere in England and Wales for the first time since 2016, underlining evidence of a rebound in the capital’s housing market.

A quarter (25.1 per cent) of London homes for sale have gone for more than their asking price in the first three months of this year, slightly ahead of the 24.5 per cent figure for England and Wales as a whole.

Five years ago London lagged substantially behind on this measure. Some 17 per cent of homes sold above their asking price across the nations in 2019, against 13 per cent in London, according to figures from estate agent Hamptons.

“This is another sign that the London market is finding its feet again after a tough period,” said Aneisha Beveridge, research director at Hamptons. “More than one kind of metric is showing this, so we can have a little more confidence in the signs of recovery.”

London trailed the rest of the market for the past seven years, as the relative expense of its housing limited buyers’ ability to afford a purchase — exacerbated more recently by soaring mortgage costs. After the pandemic took hold and working patterns changed, London also lost out on a surge in prices in the outer suburbs and beyond, and a fall in demand for flats.

Prices fell last year across most London boroughs. Overall declines in the capital’s prices were the largest of any UK nation or region.

Beveridge said: “Last year was very difficult for London because it’s the most unaffordable region in the country. And that’s naturally where high mortgage rates are going to hit hardest.”

The mood has since shifted, with prices in the capital on the rise once more, though checked by a renewed uptick in mortgage costs in recent weeks. Among the regions, London prices grew by an annual 0.4 per cent in March, compared with 0.3 per cent across the UK, according to Halifax figures on Friday.

As part of a snapshot of the national market, Rightmove, the property website, found the number of sellers listing their homes in the capital on Thursday last week was 39 per cent higher than the previous Thursday, as buyers looked to market their properties ahead of the Easter weekend. It said it was “the biggest day for sellers coming to market so far this year”.

Roarie Scarisbrick, partner at buying agent Property Vision, said the easing of mortgage rate volatility in the second half of last year and into the beginning of this year brought “a sense of relief among buyers who needed to get on with life. They said: ‘We’re not heading into a mortgage rate catastrophe. So let’s get on and do what we need to do.’” That, he said, coincided with a sense among vendors that it was no longer a seller’s market.

The time it takes for a home listed on the market to sell (or to receive an offer) is another indicator of demand. London has shown a bigger drop on this measure than any other region, Hamptons said. The average home in the capital had an offer within 57 days in the first quarter of this year, compared with 81 days over 2023.