And this pattern has repeated many times in the past decades as well.

The domestic economy is expected to continue on its healthy growth path, led by government and private sector capex spending, though advanced economies still face high inflation and slowing growth. Along with the challenges of geopolitics, all these factors leave a retail investor highly confused on how to make an asset allocation decision – apportioning money across equity (domestic & International), debt and gold (may be REITs and silver as well).

That’s where a multi-asset allocation fund works well to ensure a diversified portfolio with ingredients that have a very low correlation with each other’s movements and ensure optimal risk-adjusted returns over the long term.

These funds invest in a blend of equity, debt and gold, and are suitable for investors with a modest risk appetite and for beginners looking to build a diversified portfolio.

A multi-asset strategy works for investors

Stocks, bonds and commodities such as gold and silver move in different directions at various times.

Historically it has been observed that the movement of these asset classes have low or negative correlation with each other. The correlation coefficient tells us how price movements in two assets fluctuate in relation to each other. Equity and debt have negative correlation. Same is the case with equity and gold and also debt and gold. A negative correlation means that they move in opposite directions.

Thus, when a multi-asset portfolio with a right mix is added to a retail investor’s portfolio, the risk is considerably reduced. Since the portfolio is well diversified across multiple asset classes with low correlation there is inherent risk management and therefore such schemes make it easier for investors, especially new ones, to invest without worrying about market levels or macro conditions.

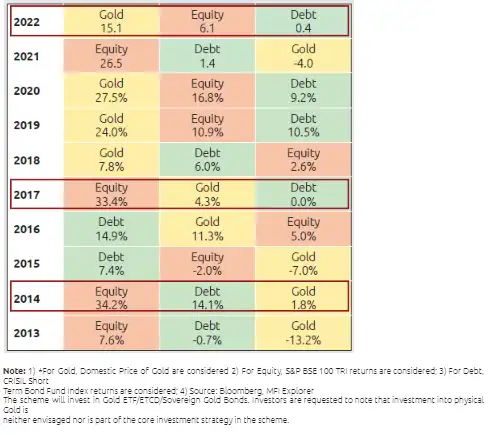

Winners keep changing

ET Online

ET OnlineIn FY 2012, at the time of the EuroZone crisis, the Sensex TRI fell 9.2%, even as MCX Gold prices rallied a whopping 32.9%. The CRISIL Short Term Bond Index gave 8.3% during that year.

In FY 2014 and FY 2015, in the immediate aftermath of a full-majority government coming to power, we had the Sensex TRI delivering 20.7% and 26.8%, respectively. CRISIL Short Term Debt Index gave 8.9% and 10.3% returns in these two fiscals. But gold ended both the financial years in the red, falling 3.2% and 8.3%.

More recently in the COVID starting year of FY 20, the Sensex TRI fell 22.9%, while gold prices rallied 29.7%. In FY 23, gold prices rose 16%, even as Sensex TRI and CRISIL Short Term Bond Index gave 2% and 4.2% returns, respectively.

The short point is that asset classes move on their own dynamics and often in different directions. Hence its difficult to predict which asset class will outperform.

A multi-asset fund attempts to deliver better risk-adjusted return through diversification across asset categories which usually tend to have differing performance cycles. Thus, these funds seek to capture the potential upside of an asset class in a favourable market cycle while managing to lower downside risk through diversification.

The downside protection possibilities was illustrated during the equity market corrections witnessed across 2018, 2020, 2021-2022 and late 2022-2023, wherein the multi-asset allocation funds corrected a lot less than the Nifty 50 in each of these occasions.

ET Online

ET OnlineA multi-asset fund can also provide distinct tax advantages based on how the asset allocation stacks up.

When the multi-asset fund has more than 65% in equities, investors get equity taxation benefits – 10% on long-term capital gains made after one year of holding. If the equity portion is 35% to 65%, investors get debt taxation – 20% on gains made after holding for 36 months – with indexation benefits.

A multi-asset fund is an all-weather proposition for an investor with a conservative outlook seeking to generate better risk adjusted returns across market cycles.

(Sailesh Raj Bhan is CIO-Equity Investments, Nippon India Mutual Fund)